Irs payroll calculator

Ad Take the hassle out of paying your employees by Letting the Software Handle the Payments. Save time and money with our hassle-free Payroll services.

Paycheck Calculator Take Home Pay Calculator

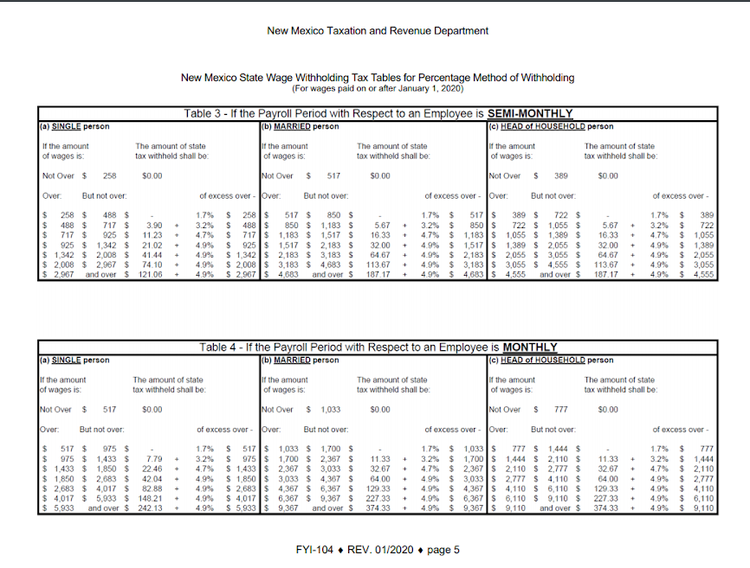

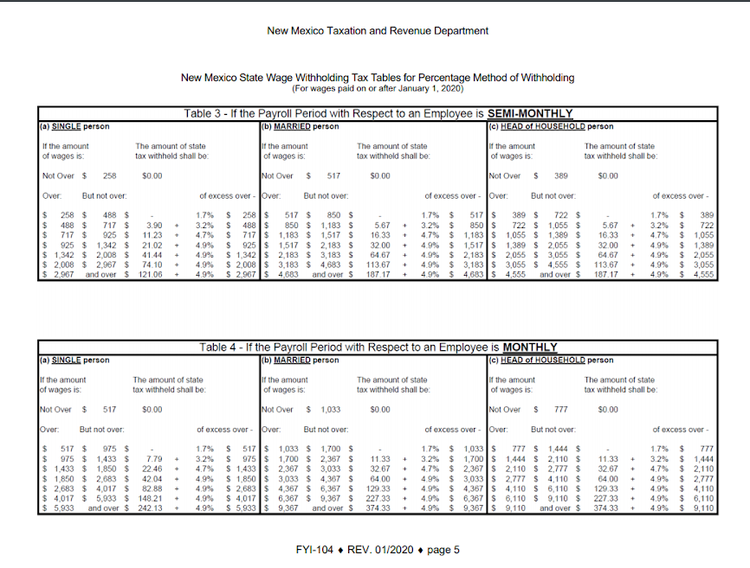

Some states follow the federal tax.

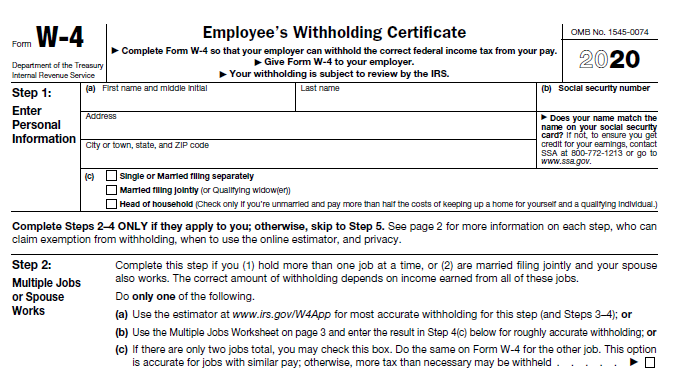

. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions. 250 and subtract the refund adjust amount from that.

Estimate your paycheck withholding with our free W-4 Withholding Calculator. Ad Payroll So Easy You Can Set It Up Run It Yourself. Boost Your Business Productivity With The Latest Simple Smart Payroll Systems.

Important note on the salary paycheck calculator. IR-2019-110 IRS Withholding Calculator can help workers have right amount of tax withheld following tax law changes. You can use the Tax Withholding.

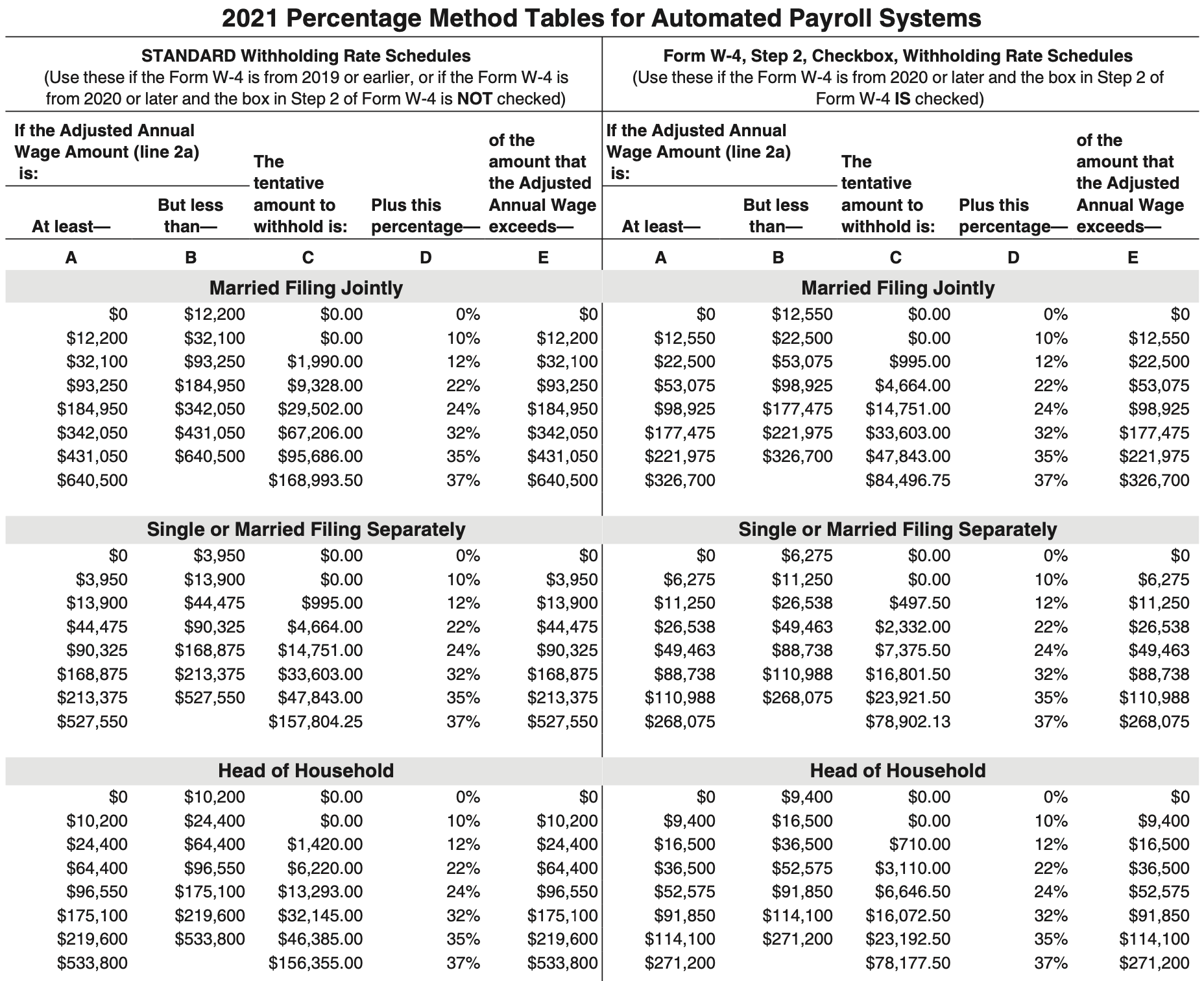

For individuals and businesses not for payroll tax deposits. It will confirm the deductions you include on your. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

Revenue Procedure 2004-53 explains both the standard procedure and an alternate procedure. Then look at your last paychecks tax withholding amount eg. The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees.

Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Ad Compare This Years Top 5 Free Payroll Software. Ad Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource.

Make Business Payments or Schedule Estimated. Taxes Paid Filed - 100 Guarantee. Besides paying 11888 tax the government will also tax your employer because.

To put it numerically you will be charged with a 364 marginal tax rate and a 216 average tax rate in Maine. My entity is merging with another what do we need to do for payroll taxes. The calculator helps you determine the.

The provided calculations do not constitute financial. Ad Compare This Years Top 5 Free Payroll Software. To ensure proper federal income tax withholding employees may use the IRS Withholding Calculator.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Pay Now by Card or Digital Wallet.

250 minus 200 50. Get the Latest Federal Tax Developments. For help with your withholding you may use the Tax Withholding Estimator.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand. Ad Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource.

People who earned less than 125000 annually or 250000 if filing. Get the Latest Federal Tax Developments. 22 hours agoThe income limits are based on your adjusted gross income AGI in either the 2020 or 2021 tax year.

The state tax year is also 12 months but it differs from state to state. Free Unbiased Reviews Top Picks. The information you give your employer on Form W4.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. Free Unbiased Reviews Top Picks. That result is the tax withholding amount.

This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Paycheck Calculator Take Home Pay Calculator

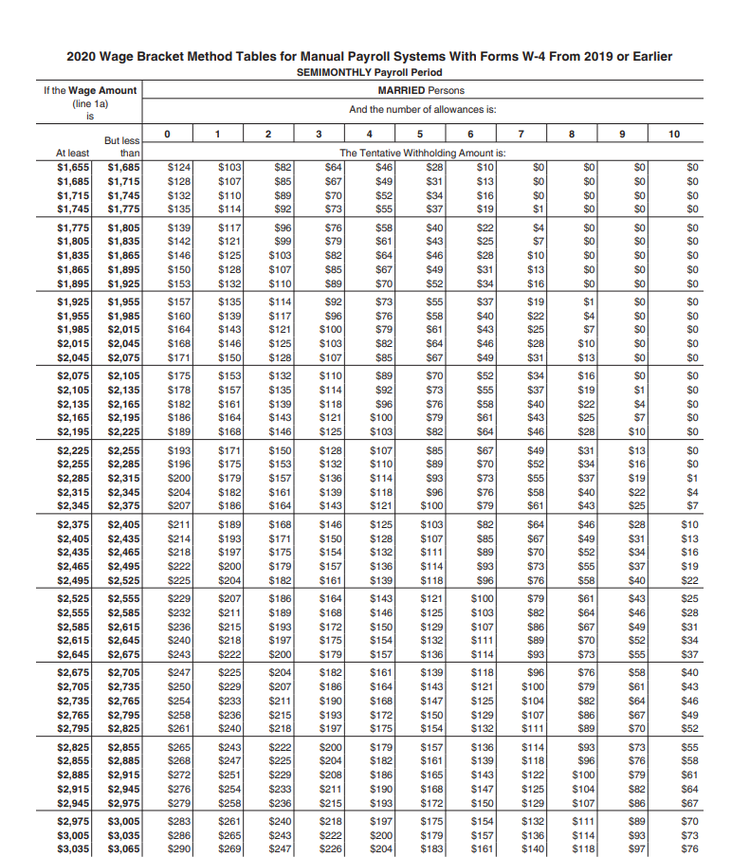

How To Calculate 2019 Federal Income Withhold Manually

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Payroll Taxes For Employees Startuplift

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate Federal Income Tax

Federal Income Tax Withholding Procedure Study Com

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

How To Calculate Payroll Taxes For Your Small Business

Calculation Of Federal Employment Taxes Payroll Services

Irs Improves Online Tax Withholding Calculator

Federal Income Tax Fit Payroll Tax Calculation Youtube

Enerpize The Ultimate Cheat Sheet On Payroll

Calculating Federal Income Tax Withholding Youtube

How To Calculate Payroll Taxes For Your Small Business

Which 2020 Withholding Table Is Correct R Tax